What life insurance, critical illness cover and/or income protection insurance do I need?

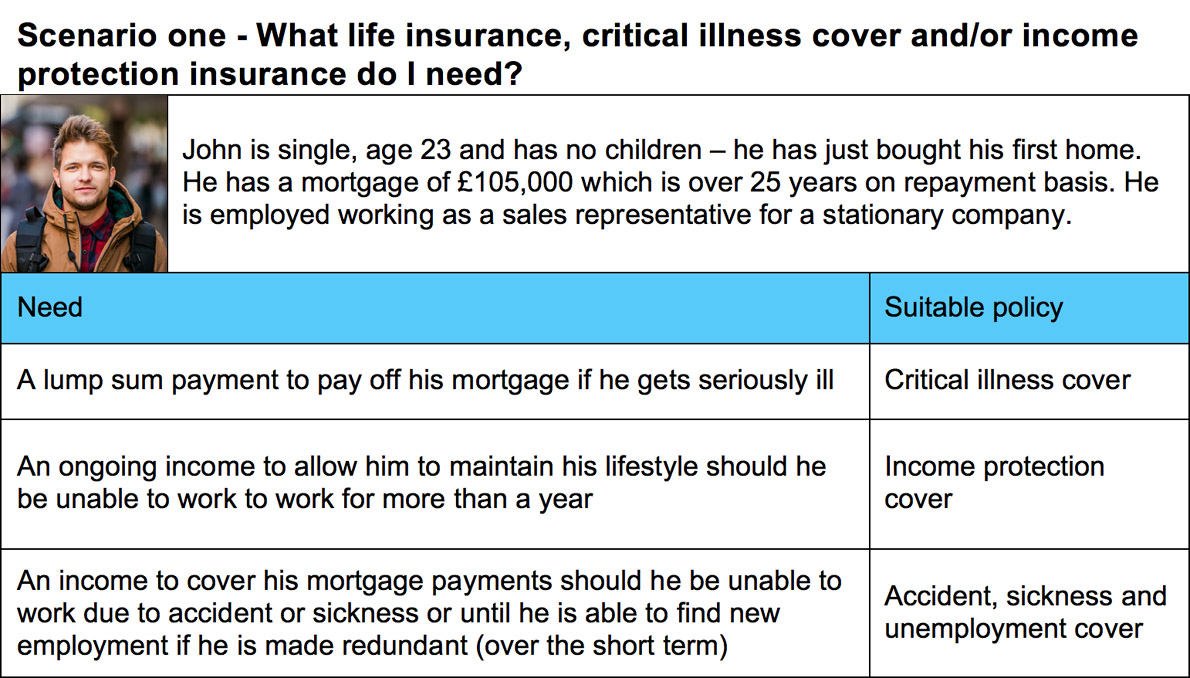

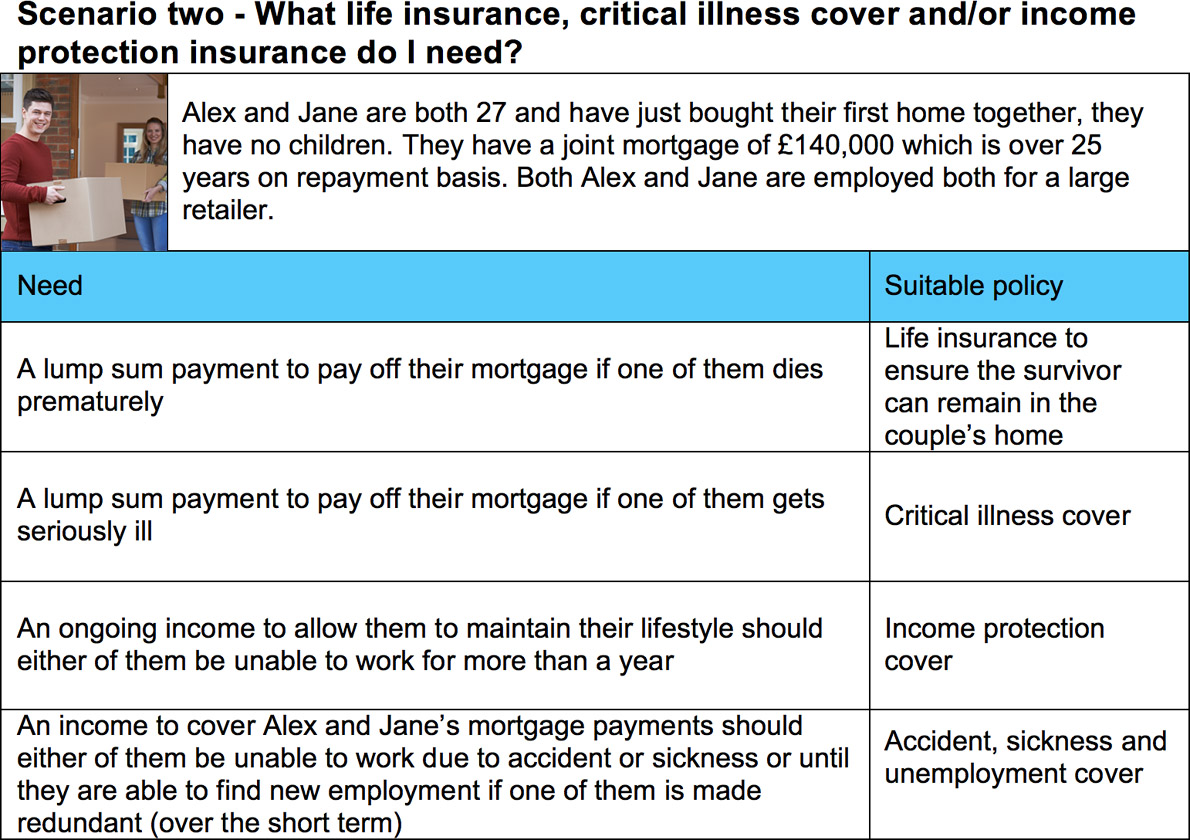

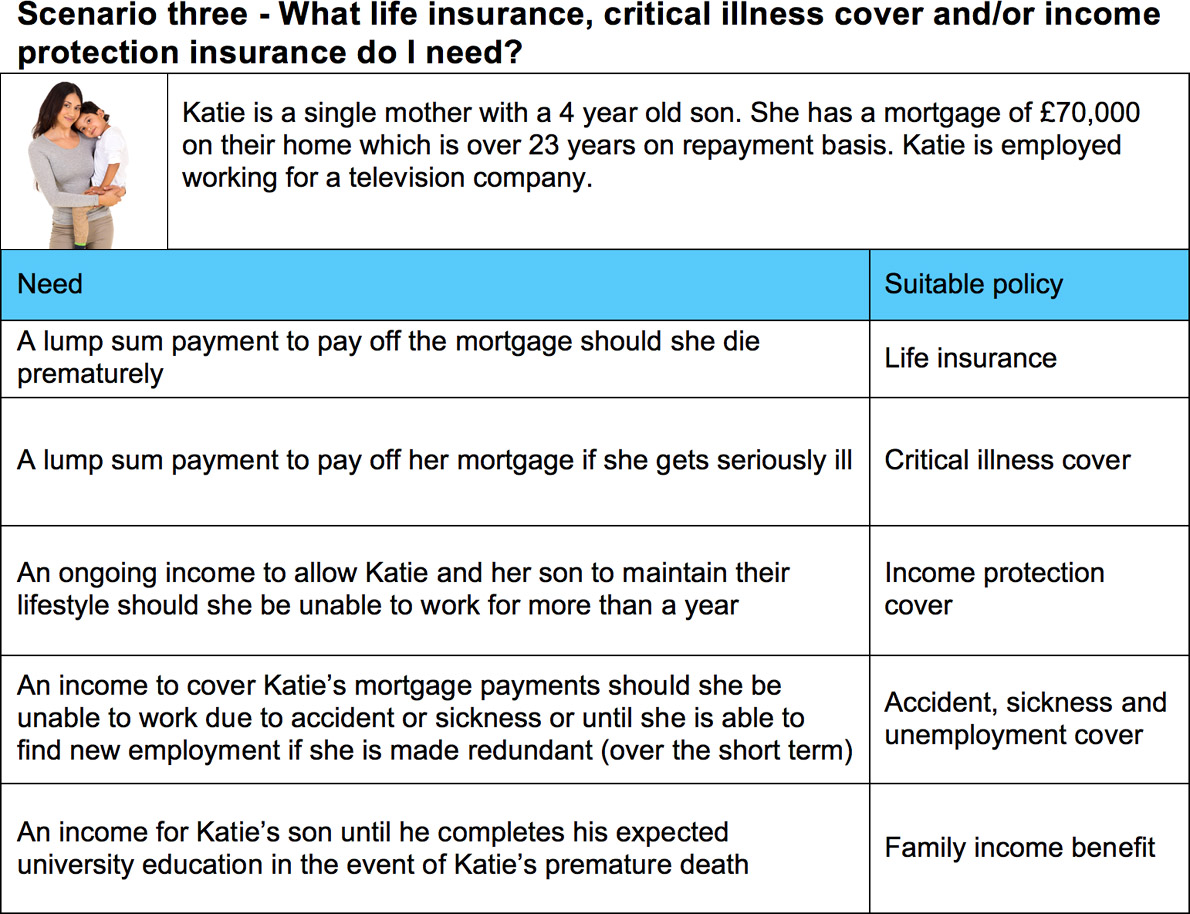

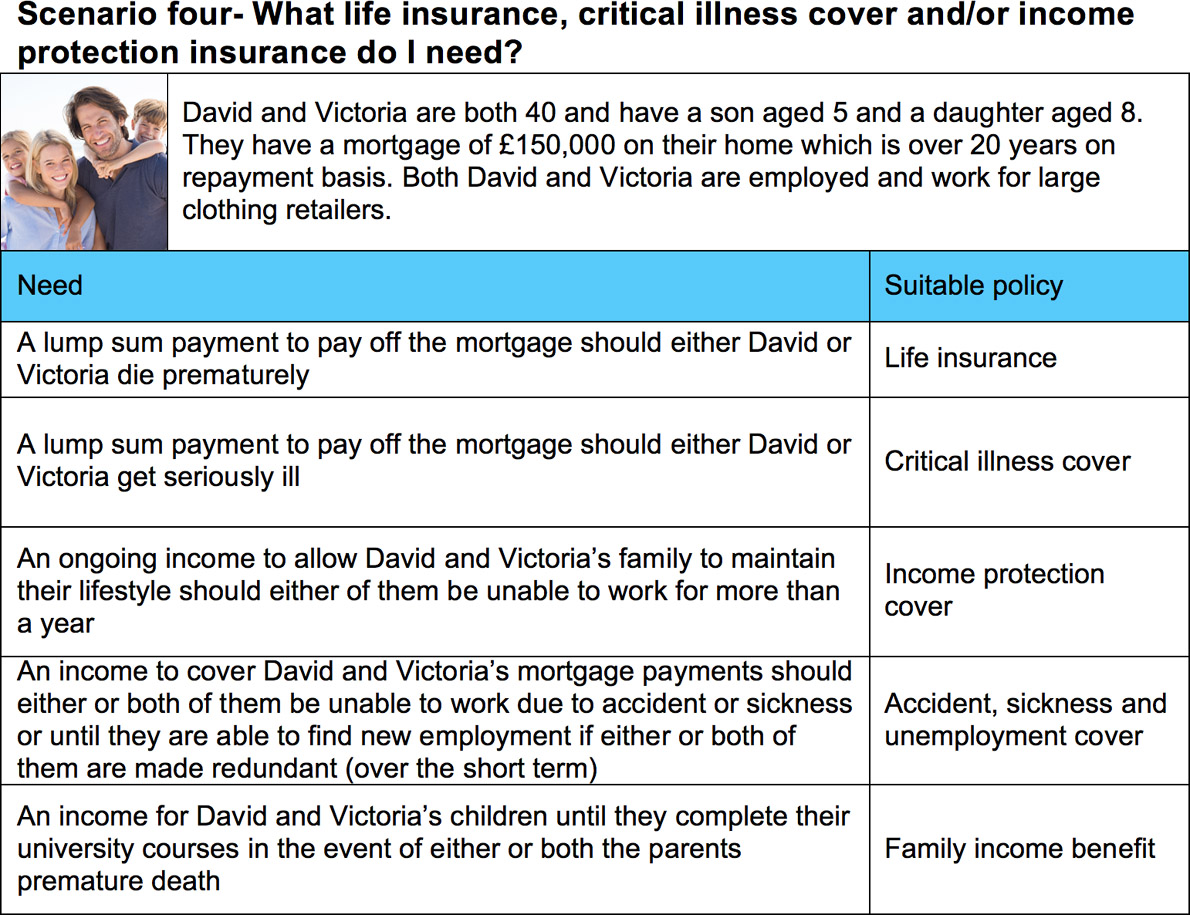

So you have decided it is worthwhile researching if you need to take life insurance, critical illness cover and/or income protection insurance in case you come across a rocky road in life, but what insurances should you be looking at? Here are some scenarios that will show you the sort of insurance protection needs different people have and the types of policies that could suit you.

These ideas are just for illustration purposes. We recommend that you speak to a protection insurance advisor at ACC Associates on (01249) 599019 to start your insurance search and take advantage of our broker and advisor service.

What do I need to do next to receive life insurance, critical illness cover and income protection insurance advice?

As mentioned above, these ideas are just for illustration purposes. You may have read the scenario relevant to your particular time and situation in life and thought “that’s a lot of insurance protection compared to what I or we currently have”. By speaking to us on (01249) 599019 ACC Associates will be able to recommend to you the appropriate insurance protection cover, based on your current needs and your all important budget. We will make you aware of what is available and ensure your insurance priorities are met – you may find that what is important and appropriate to you at this time is different to someone at exactly the same age and situation in life. It all comes down to individual insurance advice which unfortunately you won’t receive from all the places you can obtain insurance. You can rest assured you will receive personalised advice from ACC Associates, so call us on (01249) 599019.

Payment protection insurance is optional. There are other providers of Payment Protection Insurance and other products designed to protect you against the loss of income.